May 21, 2024

Investing in the Regenerative Finance Ecosystem By Sandro Stark

The value of the voluntary carbon market (VCM) has quadrupled since 2020, reaching almost US$2B in 2021. Simultaneously the movement around “Regenerative Finance” surfaced slowly out of Twitter and Discord channels into mainstream media and caught the attention of investors, project developers and contributors likewise. This article summarizes the current state and ecosystem landscape at the intersection of carbon removal, climate crypto and the flourishing on-chain carbon credit markets.

A few weeks back I was on a train

A few weeks back I was on a train heading towards Frankfurt, Germany where out of a sudden a message from a journalist popped up via LinkedIn:

“What is your responsibility as a VC towards the destruction of our planet caused by Blockchain and Crypto?”

I thought that this is the start of a wonderful friendship culminating in a cover story in Nature Magazine on how the narrative around web3 changes towards a fairer, transparent and regenerative financial system. It was quite the opposite, and we sadly got stuck in discussions about Bitcoin’s energy appetite, Crypto Token Scams and worthless NFTs. Either my arguments where to weak or he already had a fixed mindset on how he wanted to perceive crypto.

With this short article I want to create some broader visibility and awareness around the ReFi ecosystem and I am also happy to write future deep dives into specific areas of this prospering sub-genre of web3. My deep wish as a person, father, future-optimist and investor is that we can merge the passion and capital in the web3 space with the question on how we can create positive externalities while rebuilding financial and societal systems.

Difference between DeFi and ReFi

Around 2021 the movement around “Regenerative Finance” (abbr. ReFi) surfaced slowly out of discord channels into mainstream crypto media and caught the attention of investors, project developers and contributors likewise. The idea behind ReFi is to tackle climate change using blockchain technology. Or as we at Vanagon like to put it: Can we embedded financial incentives for saving the planet?

The similarity between ReFi and DeFi is the goal to solve coordination failures using Blockchain technology.

Regenerative Finance aims towards reversing climate change via Web3 technology by bringing natural assets “on-chain” and at the same time introducing a system of incentives to reward eco-friendly behavior to encourage sustainable development. One of the most vibrant and active categories in ReFi is the Voluntary Carbon Market. Most recently the venture capital firm a16z led a $70m Series A investment in Flowcarbon, a “voluntary carbon market” (VCM) cryptocurrency led by notorious Wework founder Adam Neumann.

But why are carbon credits and the value chain the main entry point for potential Blockchain usecases and why do we even need a voluntary carbon market?

Many businesses that struggle to reduce their emissions as quickly as they might wish or that find it tricky to outline a pathway to fully eliminate emissions are turning to VCMs to help. In 2020, the VCM and mandatory markets were worth approximately USD 500 million and USD 270 billion respectively. But the VCO market is expected to top USD 1 billion this year (representing approximately 300 million tonnes CO2e). This market would need to grow by at least 15 times by 2030 in order to be aligned with the 2015 Paris Agreement goal of limiting global warming to a 1.5°C rise by 2050. (Source: https://www.iif.com/tsvcm)

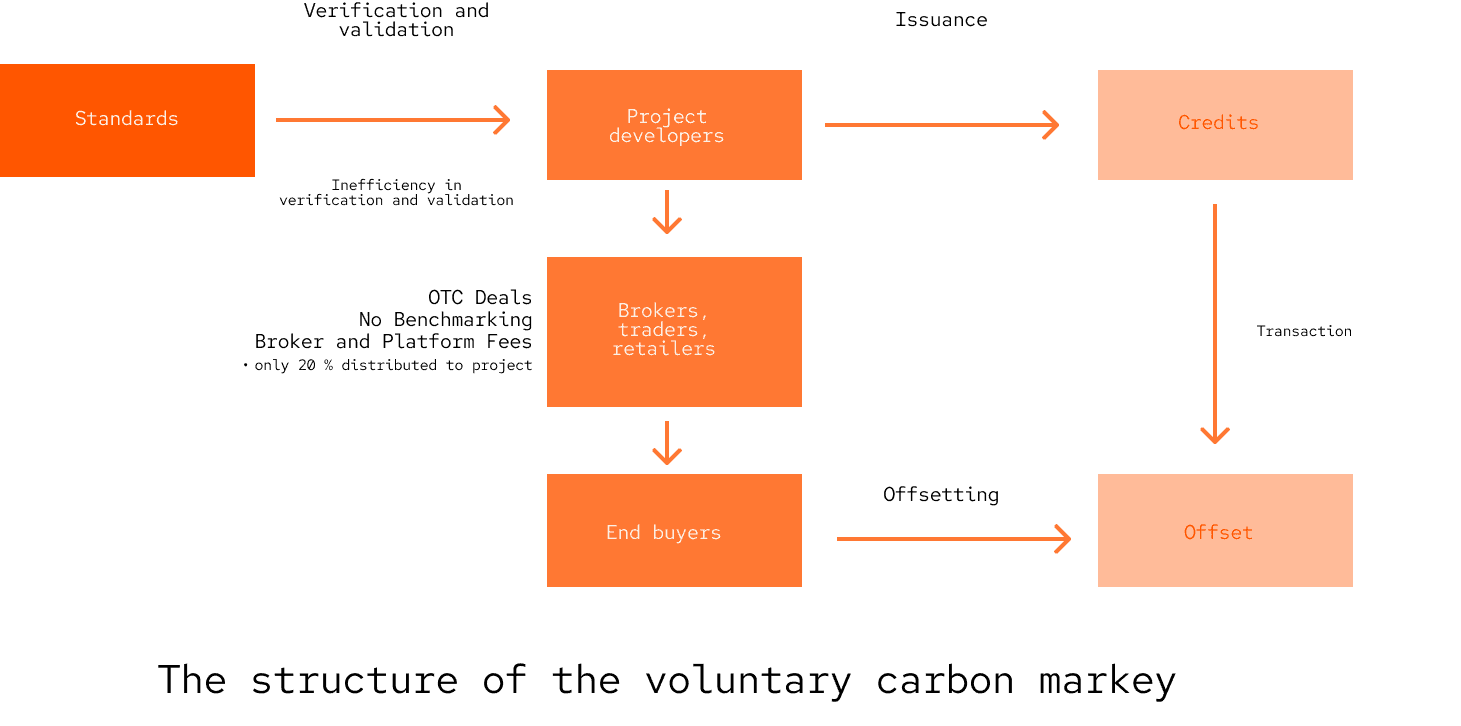

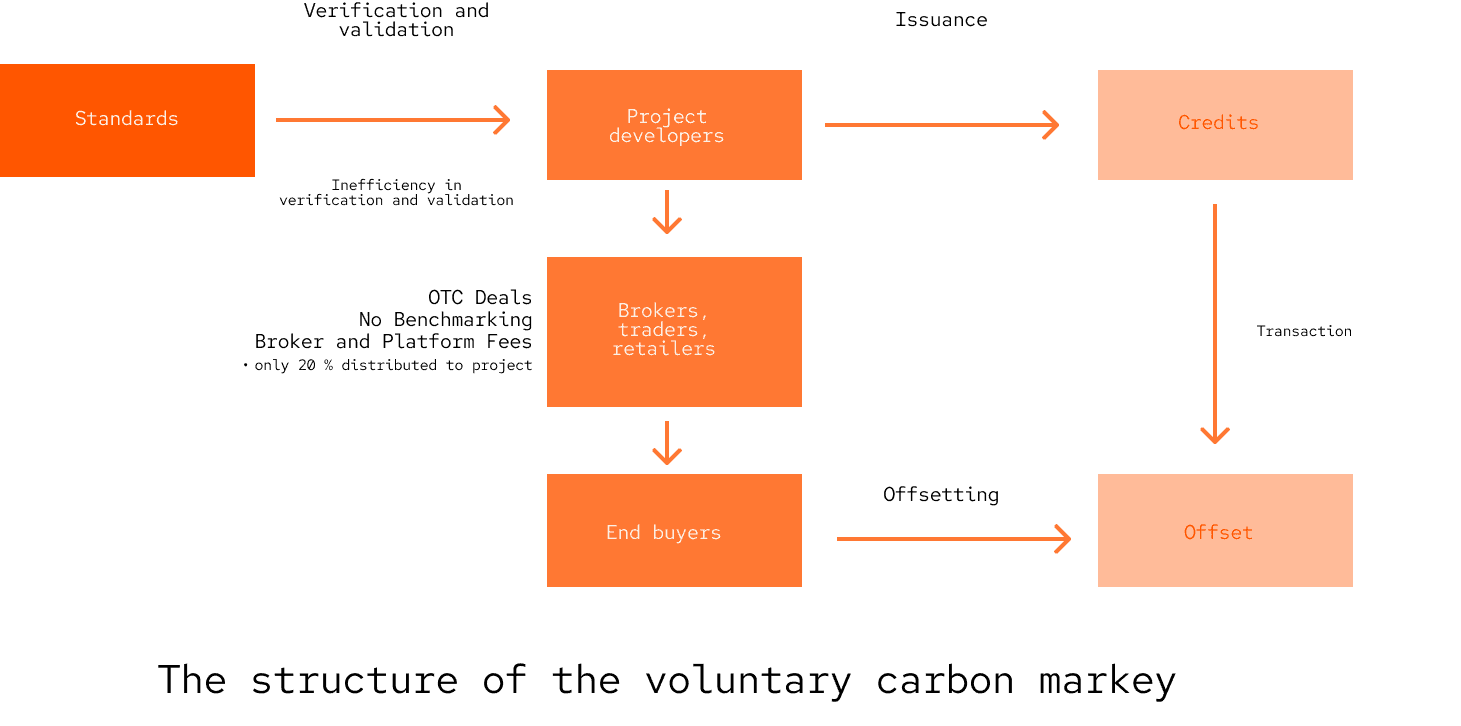

This 👆 visualization highlights one of the largest opportunities for blockchain technology at the intersection of climate impact. It is the intransparent structure of the Voluntary Carbon Market which is prone to:

Opaque OTC deals

Fraud and Greenwashing

Hard to access

However, the market is still too fragmented in order to go mainstream at scale. This is why this market is moving on-chain. Since launching in October 2021 the on-chain market has doubled the volume of the off-chain market based on data collected from S&P Global, Klima DAO, Toucan.

The main challenge and opportunity here is the standardization and harmonization across the whole supply chain. But we see another wedge for much more powerful: When we start moving from PDFs to token-based Carbon we not only make it more liquid — we make it embeddable. In a recent interview with Katharina Gehra, founder of Immutable Insights I heard an example that might resonate with a lot of people. On-chain Carbon credits could be attached directly to the emission of production machinery, offsetting the emissions on a per product scale giving customers the possibility to track down removed carbon even on a project level e.g. which forestation project.

On-chain Carbon Credits are just the catalyst for the greater ecosystem that is currently being built. I strongly believe, that we will soon have surrounding applications like parametric-index based insurance products, new data-streams from MRVs (think Chainlink for Trees) and stuff we just can’t imagine yet.

From a VC perspective

One can look at a market and if you believe in its growth you find the players that are able to catch the most sustainable value with its business model from the given market. The value of the voluntary carbon market (VCM) has quadrupled since 2020, reaching almost US$2B in 2021, according to Ecosystem Marketplace’s State of the Voluntary Carbon Markets 2022 Q3. In the field of climate finance, there are several emerging categories that address different aspects of financial activities linked to climate change mitigation and adaptation. Here are some key categories along with brief explanations:

Geo Accounting: This involves integrating geographical data into financial and economic models to better assess and manage the financial risks and opportunities associated with the geographic aspects of climate change. It helps in understanding how physical locations and their changes impact economic decisions.

Spatial Finance: Similar to Geo Accounting, Spatial Finance involves the use of geospatial data to incorporate environmental factors into financial analysis. It's used by investors to gauge climate risks associated with specific locations, such as flood risks or the impacts of deforestation.

Green Bonds: These are bonds specifically earmarked to be used for climate and environmental projects. These bonds are typically asset-linked and backed by the issuer's balance sheet, and they are designated to fund projects that have positive environmental and/or climate benefits.

Carbon Finance: This involves any financial instruments and financial services that are related to carbon trading markets, carbon credits, and financial products based on reducing emissions. This can include investments in carbon-reducing activities and trading in markets for carbon offsets.

Climate Risk Insurance: This category includes financial products that help businesses and communities manage risks associated with climate change, including severe weather events and natural disasters. These financial instruments help mitigate the financial impact of such events.

Renewable Energy Finance: This involves funding for projects related to renewable energy sources like solar, wind, hydro, and bioenergy. Investments can be in the form of equity, debt, grants, or other financial products.

Sustainable Infrastructure Finance: This category covers the financing of infrastructure projects that are sustainable, have a lower environmental impact, and are resilient to changes in climate. It includes both public and private investments.

Conclusion

As an introductory piece to this exciting and important topic I wanted to keep it short & sharp. Even after having spend some decent time in the ReFi space I truly believe, that we are just getting started. Now, after the Ethereum merge the elephant in the room is gone. Energy consumption of the major chains practically not a topic anymore and a key catalyst to now move on and solve other pressing coordination failures in the market and embed our planet and our society into the equation.

The value of the voluntary carbon market (VCM) has quadrupled since 2020, reaching almost US$2B in 2021. Simultaneously the movement around “Regenerative Finance” surfaced slowly out of Twitter and Discord channels into mainstream media and caught the attention of investors, project developers and contributors likewise. This article summarizes the current state and ecosystem landscape at the intersection of carbon removal, climate crypto and the flourishing on-chain carbon credit markets.

A few weeks back I was on a train

A few weeks back I was on a train heading towards Frankfurt, Germany where out of a sudden a message from a journalist popped up via LinkedIn:

“What is your responsibility as a VC towards the destruction of our planet caused by Blockchain and Crypto?”

I thought that this is the start of a wonderful friendship culminating in a cover story in Nature Magazine on how the narrative around web3 changes towards a fairer, transparent and regenerative financial system. It was quite the opposite, and we sadly got stuck in discussions about Bitcoin’s energy appetite, Crypto Token Scams and worthless NFTs. Either my arguments where to weak or he already had a fixed mindset on how he wanted to perceive crypto.

With this short article I want to create some broader visibility and awareness around the ReFi ecosystem and I am also happy to write future deep dives into specific areas of this prospering sub-genre of web3. My deep wish as a person, father, future-optimist and investor is that we can merge the passion and capital in the web3 space with the question on how we can create positive externalities while rebuilding financial and societal systems.

Difference between DeFi and ReFi

Around 2021 the movement around “Regenerative Finance” (abbr. ReFi) surfaced slowly out of discord channels into mainstream crypto media and caught the attention of investors, project developers and contributors likewise. The idea behind ReFi is to tackle climate change using blockchain technology. Or as we at Vanagon like to put it: Can we embedded financial incentives for saving the planet?

The similarity between ReFi and DeFi is the goal to solve coordination failures using Blockchain technology.

Regenerative Finance aims towards reversing climate change via Web3 technology by bringing natural assets “on-chain” and at the same time introducing a system of incentives to reward eco-friendly behavior to encourage sustainable development. One of the most vibrant and active categories in ReFi is the Voluntary Carbon Market. Most recently the venture capital firm a16z led a $70m Series A investment in Flowcarbon, a “voluntary carbon market” (VCM) cryptocurrency led by notorious Wework founder Adam Neumann.

But why are carbon credits and the value chain the main entry point for potential Blockchain usecases and why do we even need a voluntary carbon market?

Many businesses that struggle to reduce their emissions as quickly as they might wish or that find it tricky to outline a pathway to fully eliminate emissions are turning to VCMs to help. In 2020, the VCM and mandatory markets were worth approximately USD 500 million and USD 270 billion respectively. But the VCO market is expected to top USD 1 billion this year (representing approximately 300 million tonnes CO2e). This market would need to grow by at least 15 times by 2030 in order to be aligned with the 2015 Paris Agreement goal of limiting global warming to a 1.5°C rise by 2050. (Source: https://www.iif.com/tsvcm)

This 👆 visualization highlights one of the largest opportunities for blockchain technology at the intersection of climate impact. It is the intransparent structure of the Voluntary Carbon Market which is prone to:

Opaque OTC deals

Fraud and Greenwashing

Hard to access

However, the market is still too fragmented in order to go mainstream at scale. This is why this market is moving on-chain. Since launching in October 2021 the on-chain market has doubled the volume of the off-chain market based on data collected from S&P Global, Klima DAO, Toucan.

The main challenge and opportunity here is the standardization and harmonization across the whole supply chain. But we see another wedge for much more powerful: When we start moving from PDFs to token-based Carbon we not only make it more liquid — we make it embeddable. In a recent interview with Katharina Gehra, founder of Immutable Insights I heard an example that might resonate with a lot of people. On-chain Carbon credits could be attached directly to the emission of production machinery, offsetting the emissions on a per product scale giving customers the possibility to track down removed carbon even on a project level e.g. which forestation project.

On-chain Carbon Credits are just the catalyst for the greater ecosystem that is currently being built. I strongly believe, that we will soon have surrounding applications like parametric-index based insurance products, new data-streams from MRVs (think Chainlink for Trees) and stuff we just can’t imagine yet.

From a VC perspective

One can look at a market and if you believe in its growth you find the players that are able to catch the most sustainable value with its business model from the given market. The value of the voluntary carbon market (VCM) has quadrupled since 2020, reaching almost US$2B in 2021, according to Ecosystem Marketplace’s State of the Voluntary Carbon Markets 2022 Q3. In the field of climate finance, there are several emerging categories that address different aspects of financial activities linked to climate change mitigation and adaptation. Here are some key categories along with brief explanations:

Geo Accounting: This involves integrating geographical data into financial and economic models to better assess and manage the financial risks and opportunities associated with the geographic aspects of climate change. It helps in understanding how physical locations and their changes impact economic decisions.

Spatial Finance: Similar to Geo Accounting, Spatial Finance involves the use of geospatial data to incorporate environmental factors into financial analysis. It's used by investors to gauge climate risks associated with specific locations, such as flood risks or the impacts of deforestation.

Green Bonds: These are bonds specifically earmarked to be used for climate and environmental projects. These bonds are typically asset-linked and backed by the issuer's balance sheet, and they are designated to fund projects that have positive environmental and/or climate benefits.

Carbon Finance: This involves any financial instruments and financial services that are related to carbon trading markets, carbon credits, and financial products based on reducing emissions. This can include investments in carbon-reducing activities and trading in markets for carbon offsets.

Climate Risk Insurance: This category includes financial products that help businesses and communities manage risks associated with climate change, including severe weather events and natural disasters. These financial instruments help mitigate the financial impact of such events.

Renewable Energy Finance: This involves funding for projects related to renewable energy sources like solar, wind, hydro, and bioenergy. Investments can be in the form of equity, debt, grants, or other financial products.

Sustainable Infrastructure Finance: This category covers the financing of infrastructure projects that are sustainable, have a lower environmental impact, and are resilient to changes in climate. It includes both public and private investments.

Conclusion

As an introductory piece to this exciting and important topic I wanted to keep it short & sharp. Even after having spend some decent time in the ReFi space I truly believe, that we are just getting started. Now, after the Ethereum merge the elephant in the room is gone. Energy consumption of the major chains practically not a topic anymore and a key catalyst to now move on and solve other pressing coordination failures in the market and embed our planet and our society into the equation.