Investing in the Regenerative Finance Ecosystem

May 21, 2024

Digital Deeptech Venture Capital from Munich

A resilient and sustainable Europe is our most pressing challenge.

Technology will make us move faster.

A resilient and sustainable Europe is our most pressing challenge.

Technology will make us move faster.

A resilient and sustainable Europe is our most pressing challenge.

Technology will make us move faster.

FiNANCE

$44T of economic output is directly dependent on nature. Founded by Ex-McKinsey director and serial entrepreneurs, The Landbanking Group is a category definer – restoring and protecting nature at scale and driving prosperity. Enabled by AI & remote sensing, it establishes a new asset class that shifts incentives towards regenerative land-use practices.

AI Automation

Materials R&D

FiNANCE

$44T of economic output is directly dependent on nature. Founded by Ex-McKinsey director and serial entrepreneurs, The Landbanking Group is a category definer – restoring and protecting nature at scale and driving prosperity. Enabled by AI & remote sensing, it establishes a new asset class that shifts incentives towards regenerative land-use practices.

FiNANCE

$44T of economic output is directly dependent on nature. Founded by Ex-McKinsey director and serial entrepreneurs, The Landbanking Group is a category definer – restoring and protecting nature at scale and driving prosperity. Enabled by AI & remote sensing, it establishes a new asset class that shifts incentives towards regenerative land-use practices.

INDUSTRIAL

ExoMatter leverages AI and quantum mechanical modeling to revolutionize materials R&D, helping companies uncover completely new materials optimized for properties, cost, and sustainability, while making the R&D process up to 90% faster, 90% cheaper, and emitting 80% less GHG emissions.

AI Automation

Materials R&D

INDUSTRIAL

ExoMatter leverages AI and quantum mechanical modeling to revolutionize materials R&D, helping companies uncover completely new materials optimized for properties, cost, and sustainability, while making the R&D process up to 90% faster, 90% cheaper, and emitting 80% less GHG emissions.

INDUSTRIAL

ExoMatter leverages AI and quantum mechanical modeling to revolutionize materials R&D, helping companies uncover completely new materials optimized for properties, cost, and sustainability, while making the R&D process up to 90% faster, 90% cheaper, and emitting 80% less GHG emissions.

CLIMATE

Founded in 2021, Senken is now a global top 3 marketplace for carbon removal and biodiversity credits. Senken has helped >360 companies to neutralize emissions, risk-free. Additionally, Senken enables innovative use cases, such as automatic offsetting.

Carbon exchange

Marketplace

CLIMATE

Founded in 2021, Senken is now a global top 3 marketplace for carbon removal and biodiversity credits. Senken has helped >360 companies to neutralize emissions, risk-free. Additionally, Senken enables innovative use cases, such as automatic offsetting.

CLIMATE

Adrian and Djamel started Senken to connect companies to climate projects, making it easy to trade carbon credits and reach net-zero goals.

INDUSTRIAL TECH

The manufacturing sector is vital to Europe's economy, but growth needs speed. Bench enables AI-powered automation, allowing one engineer to handle tasks once managed by entire teams. With seamless integration, Bench accelerates design iterations, helping teams create efficient, sustainable hardware for long-term impact.

Hardware Engineering

Resource-efficient design

INDUSTRIAL TECH

The manufacturing sector is vital to Europe's economy, but growth needs speed. Bench enables AI-powered automation, allowing one engineer to handle tasks once managed by entire teams. With seamless integration, Bench accelerates design iterations, helping teams create efficient, sustainable hardware for long-term impact.

INDUSTRIAL TECH

Adrian and Djamel started Senken to connect companies to climate projects, making it easy to trade carbon credits and reach net-zero goals.

INDUSTRIAL TECH

Labor shortages and rising product complexity are challenging factories. 36ZERO Vision’s AI-powered platform replaces manual inspections with self-learning automation, reducing waste and cutting costs. It runs on any hardware, learns new defects quickly, and allows non-experts to configure inspections without coding.

Vision AI

Manufacturing

INDUSTRIAL TECH

Labor shortages and rising product complexity are challenging factories. 36ZERO Vision’s AI-powered platform replaces manual inspections with self-learning automation, reducing waste and cutting costs. It runs on any hardware, learns new defects quickly, and allows non-experts to configure inspections without coding.

INDUSTRIAL TECH

Adrian and Djamel started Senken to connect companies to climate projects, making it easy to trade carbon credits and reach net-zero goals.

We focus on accelerating Europe through investments in AI-Native & DeepTech founders across the DACH region.

We focus on accelerating Europe through investments in AI-Native & DeepTech founders across the DACH region.

CIRCULARITY

AI EDTECH

CIRCULARITY

AI AUTOMATION

AI AUTOMATION

Venture Capital for a

New Nature of Business.

Venture Capital for a

New Nature of Business.

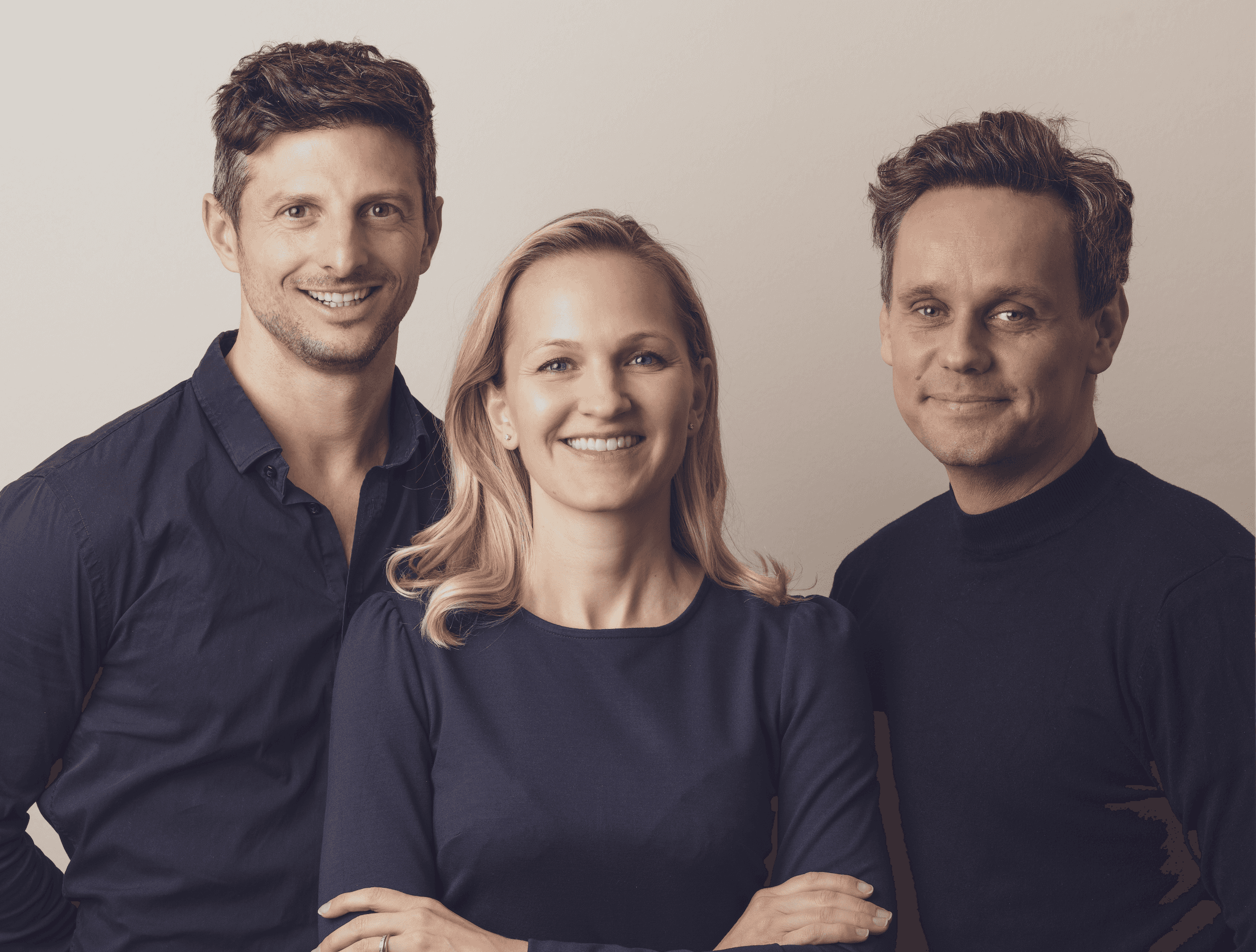

We are a high-conviction pre-seed firm, harnessing Digital DeepTech expertise and powerful B2B networks, e.g. from Microsoft, Roland Berger, INSEAD and our own ventures, to fuel a new Nature of Business, straight from Munich.

Venture Capital for a New Nature of Business