ETHOS

By investing in DeepTech innovations Europe could create $1 trillion in enterprise value and up to 1 million jobs by 2030 - paving the way for a sustainable, resilient and economically thriving Europe.

From Day One

We back DeepTech founders from day one, where the doubt, the risk, and the magic live.

100% Conviction

Whether you’re leaving the lab, a job, or starting again, we’re here, sleeves up, by your side.

Why we exist

AI changes everything — the steepest value creation has shifted to the earliest stages. Yet legacy VCs still rely on SaaS playbooks that don’t fit DeepTech and avoid pre-seed.

Purpose-built for (Pre-)Seed

Most early-stage funds aren’t built for pre-seed. They talk conviction but wait for proof.

No legacy VC

Most VCs fund familiarity. We look for divergence as all our Founding Partners come from non legacy VC backgrounds.

Key Verticals

DeepTech and AI-Native in Advanced Manufacturing, Future Materials, Geospatial Intelligence, Artificial Intelligence and Next-Gen Computing

Up to €500k in first rounds

As lead investor, we unlock additional funding from our close network. Beyond Germany, we like to partner with mission-aligned co-investors.

About Us

Venture Capital for a New Nature of Business

We built Vanagon from the ground up: from outsiders for outperformers.

If you’re a relentless, purpose-driven founder on a life’s mission to build a legacy-defying company - we want to meet you.

Beyond the Investment

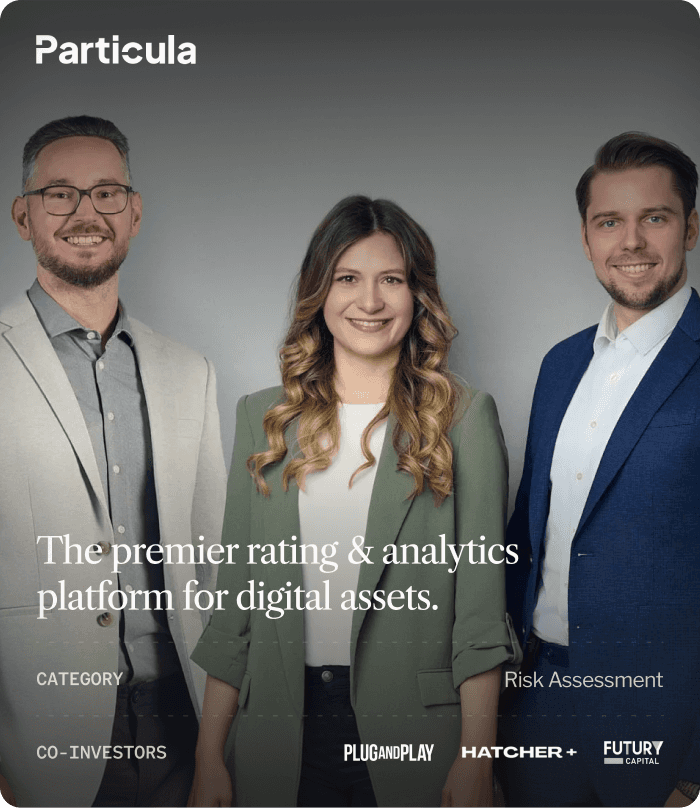

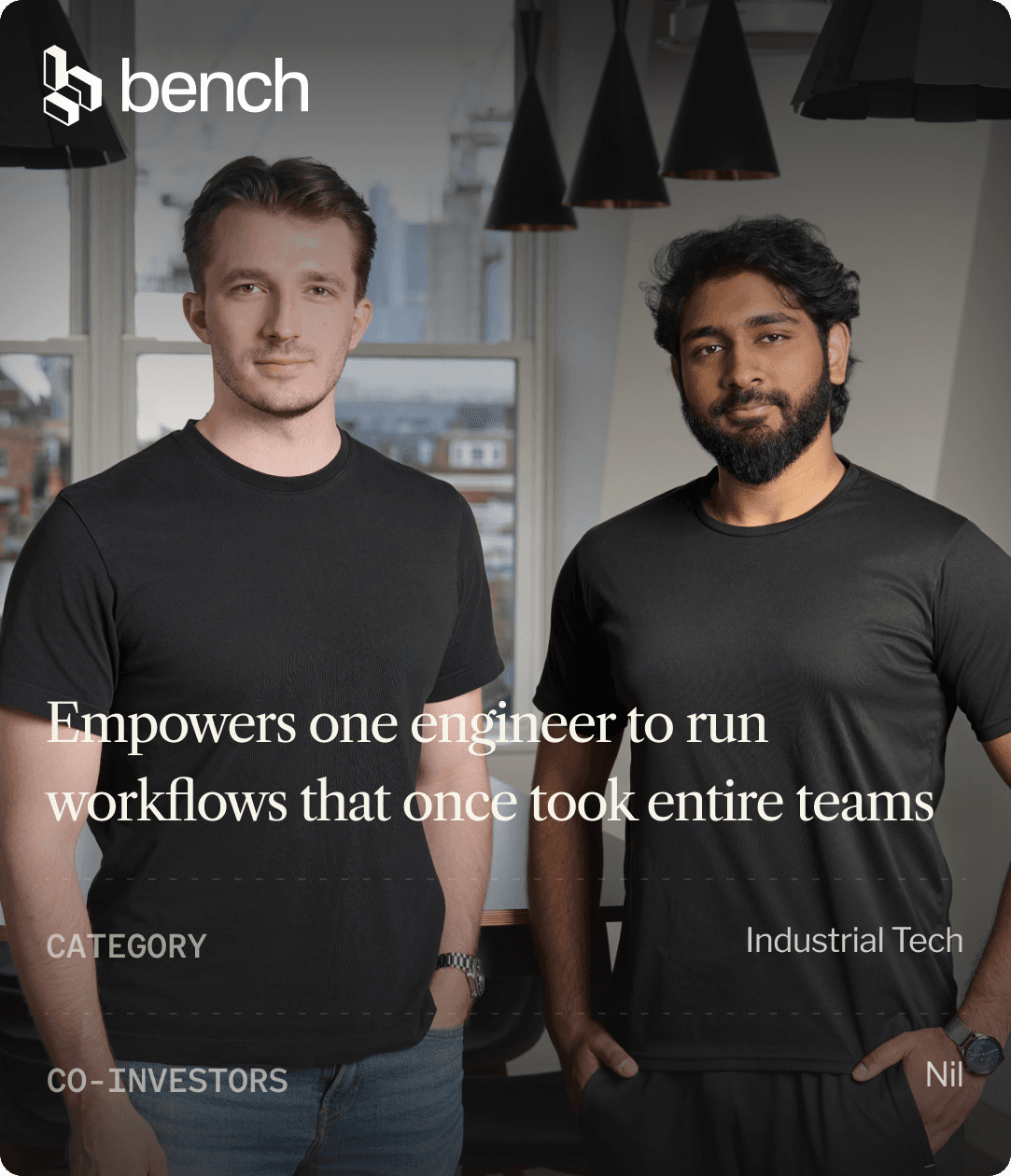

Portfolio

We dare to be there from the start. Backing founders who are on their life's mission.

Groupthink leaves breakthroughs unfunded. We are different, spot them, and translate their potential.

Full Portfolio

INSIGHTS

Notes worth sharing.